multistate tax commission allocation and apportionment regulations

In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment. The Draft Amendments to the Commissions Model General Allocation and Apportionment Regulations were approved and commended to the Commission for adoption as a uniformity.

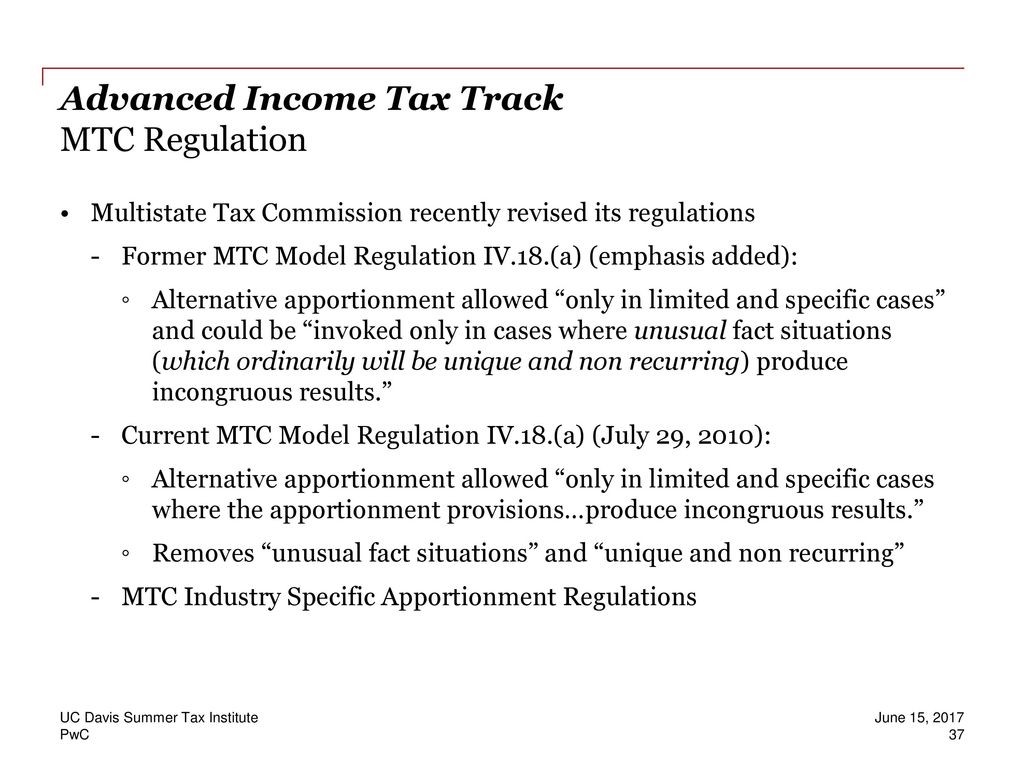

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Adopted February 21 1973.

. Gorrod analyzed the Model General Allocation and Apportionment Regulations. On February 24 2017 the Multistate Tax Commission adopted amendments to its Model General Allocation and Apportionment Regulations. Multistate Tax Commission Adopts Income Apportionment Rules.

Noonan and Paul R. Application of the apportionment and allocation provisions of Article IV of the Multistate Tax Compact. Stress points that often produce significant difficulties include apportionment issues stemming from the mixed entity and aggregate treatment of flowthrough entities the.

21 Mar 2017. In general under New Jersey law. Ment statutes govern the allocation of both state and federal taxes in the absence of an overriding tax-apportionment clause within a will or trust.

As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact. The amendments to the model. 48 State Tax Notes 1063 June 30 2008 Multistate Taxation of Stock Option Income -- Time for a National Solution.

Allocation and Apportionment Regulations. The Allocation and Apportionment Regulations were adopted by the Multistate Tax Commission on February 21 1973. The Multistate Tax Commission MTC regulations construe the Uniform Division of Income for Tax Purposes Act UDITPA as establishing a presumption in favor of.

A and b were revised on July 14 1988. This rule is intended as an interpretive guideline in the application of Article VI of the Multistate Tax Compact section 32200 RSMo implemented by adopting the Multistate Tax. Comeau In recent years states have.

Pursuant to the Multistate Tax Commission MTC Uniformity Committees project for adoption of amendments to its Model General Allocation and Apportionment Regulations which began. The apportionment rules set forth in these Regulations are applicable to any.

Podcast Apportionment Sourcing What You Need To Know Pkf Mueller

Usa State Local Tax Top Stories Of 2015

Draft Workgroup Memo Multistate Tax Commission

Pdf Formulary Apportionment And Group Taxation In The European Union Insights From The United States And Canada

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Why States Should Adopt The Mtc Model For Federal Partnership Audits

Acct 4400 Salt 2 Apportionment Multijurisdictional Tax Issues Uses Of Local State Taxes Acct 570 Ch 12 State Local Taxes 4400 Multi Jurisdictional Tax State And Local Taxation Tax Law Test 1 State Tax Tax Chapter 23 State And Loca

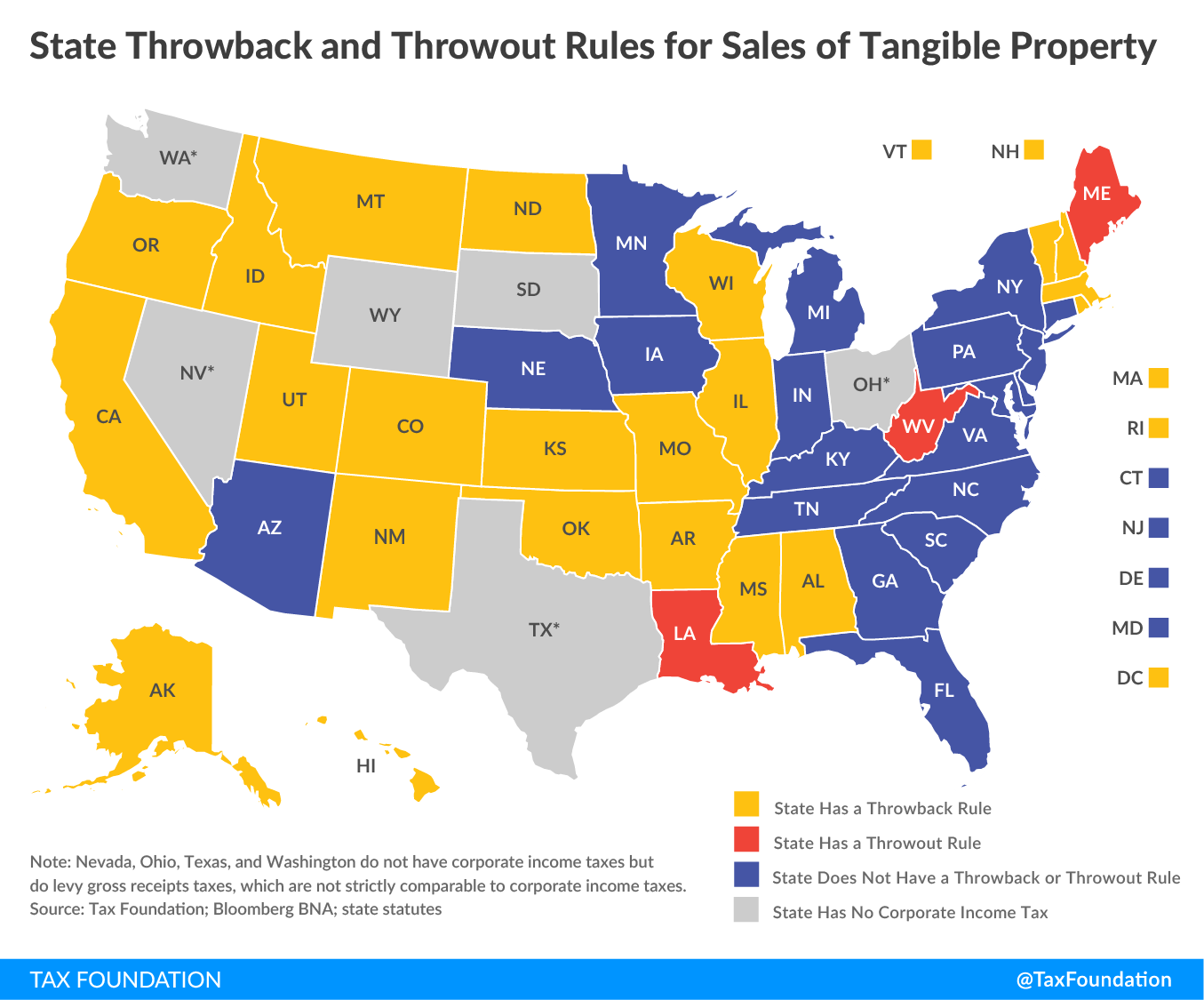

State Throwback Rules And Throwout Rules A Primer Tax Foundation

Multistate Tax Commission With Helen Hecht Taxops

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Apportioning Income From Sales Of Services The Cpa Journal

Proposed Amendments Would Change Apportionment Rules

Memorandum To Multistate Tax Commission

Multi State Sales Apportionment For Income Tax Reporting Withum

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Cooking With Salt Law Jones Walker Llp